by Bethany Blankley

As the nation struggles with record high unemployment, extended job losses, continued statewide shutdowns, and crippling national debt, a new report reveals that congressional leaders will receive an estimated $1 million each in retirement payouts on top of their lifetime pensions, fully funded by taxpayers.

First published by Forbes, OpenTheBooks.com’s report, “Why Are Taxpayers Providing Public Pensions To Millionaire Members Of Congress?” compares the financial benefits that both top leaders in Congress receive.

“We’ve said it before and we’ll say it again – Congress is an exclusive club where members vote for their own benefits,” Adam Andrzejewski, CEO and founder of the nonprofit watchdog organization, says.

By law, all 535 members of Congress receive a public pension plan and a taxpayer-funded, five-percent of salary 401(k)-style savings plan, in addition to salaries of $174,000 and higher.

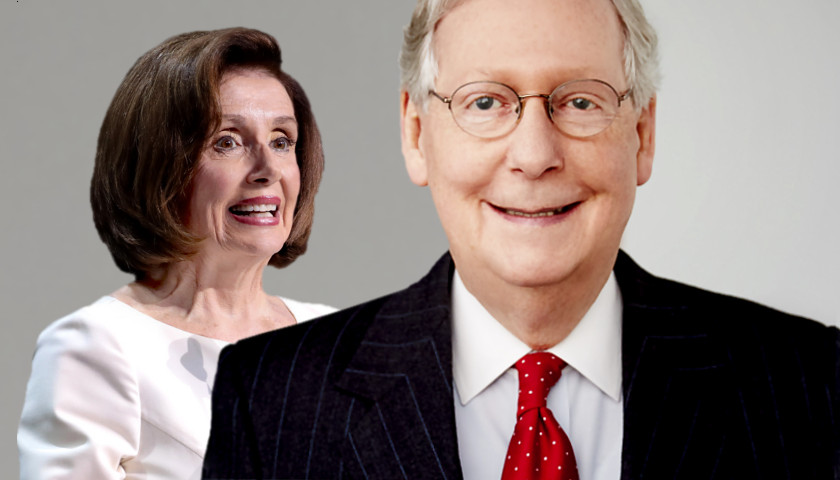

Speaker of the House Nancy Pelosi’s net worth is reportedly between $50 million and $72 million; Senator Majority Leader Mitch McConnell’s net worth is reportedly roughly $22 million. Their current salaries are $223,500 and $193,400, respectively.

Pelosi has received $5.7 million in total salary for the 34 years she has been in office. McConnell has received $5.5 million for the 36 years he’s been in office.

Both the Speaker and the Majority Leader voted for several spending packages this year, including the CARES Act and the Families First relief bill, which will increase the national debt by $1.76 trillion, and $192 billion, respectively, according to the Congressional Budget Office (CBO). The small business relief act added $480 billion to the total.

Spending increases and tax cuts in coronavirus legislation may increase debt initially by roughly $2.4 trillion.

Chris Edwards, an economist at the Cato Institute, estimates that the effect of the recession will reduce federal revenues a further $2.2 trillion over the next few years. With higher spending and lower revenues, federal borrowing costs are expected to be approximately $1.2 trillion higher over the next decade.

The basic CBO estimates exclude these costs, Edwards notes. All told, these decisions will add an estimated $5.8 trillion to the national debt.

And both leaders are expected to vote on another stimulus bill, which will add to this total.

Part of the spending problem contributing to this debt, OpenTheBooks.com notes, is the taxpayer-funded lifetime pension and taxpayer-matched savings plans members of Congress receive.

“Critics question the necessity of such a system,” Andrzejewski writes. “Why are U.S. taxpayers providing public pensions to millionaire members of Congress on top of a 401(k)-style plan? (The median net worth for a member recently exceeded $1.1 million.)”

Auditors at OpenTheBooks.com evaluated the financial benefits Pelosi and McConnell receive from taxpayers.

When Pelosi retires, she will receive $153,967 a year in public pension and Social Security benefits, in addition to an estimated $1 million lump sum through her federal saving account, OpenTheBooks auditors found. They explain this “is just the portion of the account that was taxpayer-funded.”

Taxpayers also paid $282,965 into Pelosi’s federal Thrift Savings Plans, which OpenTheBooks estimates grew to $1.03 million if invested in an S&P 500 index fund, as of Dec. 31, 2019.

Similar to Pelosi, taxpayers invested $273,700 into McConnell’s federal Thrift Savings Plans, which OpenTheBooks auditors estimates grew to $1.1 million if invested in an S&P 500 index fund as of Dec. 31, 2019. They add, this “is just the portion of the account that was taxpayer-funded.”

Researchers at the National Taxpayers Union estimate that McConnell’s pension and annuity package will be $142,902 annually if he retires after the 2020 November election.

U.S. Sen. Mike Braun, R-Indiana, has proposed a bill to change the law, arguing that members of Congress have the “option to forego the generous retirement plans offered to representatives and senators and opt instead for a more conservative, savings-based plan like those of the Americans they represent.”

The bill, S.439, passed the U.S. Senate on Dec. 19, 2019, and sits in the House.

Braun notes that the median minimum net worth of members of the 115th Congress was $511,000, while the median net worth of a U.S. household in 2016 was $97,300.

The collective wealth of members of the 115th Congress was at least $2.43 billion, with 43 members who were millionaires, he said.

Even factoring in federal employees, only 23 percent of all U.S. workers contribute to a traditional pension, Braun adds, down from 38 percent in 1980, as traditional pensions continue to be phased out by private sector companies in favor of 401ks and other savings plans.

– – –

Bethany Blankley is a regular contributor to The Center Square.

Photo “Rep. Nancy Pelosi” by Gage Skidmore CC2.0. Photo “Senator Mitch McConnell” by Sen. Mitch McConnell.

No outrage here, because those payouts weren’t received by the little guy. If a thousand “little guys” got it, then you’d see the usual suspects whining about it.